What is Participation Rate?

Determining 401(k) participation rate has historically been less a science and more of an estimate. The biggest reason for a lack of visibility is because 401(k) plans are reported to the government on a plan level and studies have to rely on surveys such as this one conducted by Plan Sponsor Council of America (PSCA) to gather data. The result is that there are different participation rates cited such as:

Vanguard in 2018: 74%

PSCA in 2017: 84%

88.7% had a balance

84% made a contribution

Fidelity in 2018: 73.5%

Autoenrollment plans: 88.3%

Non-autoenrollment plans: 52.3%

Guideline in 2019: 83%

Paychex in 2018: 79% (Autoenrollment)

You may ask yourself, what criteria makes up that percentage? I did some digging and have found that the common assumption to define participation rate is to divide eligible participants with a balance by total eligible participants. At first, this seems correct but after further investigation there is misleading criteria that skews this data. If the true goal of “participation” is to measure the percentage of employees that are deferring their own money into the plan, then this data is skewed due to non-elective and profit sharing contributions.

Non-elective contributions

A non-elective contribution is a certain percentage of an employee’s salary that is contributed to the employee’s 401(k) plan by the employer. The 3% Safe Harbor non-elective is most widely used by small business 401(k) plans. For example, Participant A has a salary of $50,000, the employer will contribute 3% ($1500) into their account; this amount is tax deductible to the employer.

Profit-Sharing Contributions

For small business 401(k) plans, profit sharing is a common way to maximize tax savings. Profit sharing contributions adds an extra feature that allows an employer to make contributions to their employee’s 401(k) accounts based on their profits. This benefits the employees by giving them a sense of ownership in the business. It also benefits the company by creating a tax shelter and allowing key employees to maximize their contributions for the year.

Neither option requires an employee to contribute their own money in order to receive an employer contribution, but it meets the criteria of an eligible participant with a balance. In our opinion, it is much more accurate to calculate the participation rate by taking the actively contributing participants (those contributing via pre-tax or Roth each pay period) divided by total eligible participants.

In an email response from PlanSponsor magazine quoted, “While some plan sponsors include participants in their participation rate who are receiving only employer contributions made to the plan, we define participation as actively deferring into the 401(k).”

Other misleading factors that skew participation rates.

Age of the participant

Younger workers typically are more focused on saving for goals other than retirement. Those can vary from buying a house, paying off student loans, or starting a family. Older workers are more likely to participate in a retirement plan. A study by Investment Company Institute (IC I) shows that workers aged from 26 to 34 showed a 50% participation rate, but workers from 55 to 65 showed 61% participation.

Lower paying professions

Lower income workers are less willing to save for retirement. A similar study by ICI showed that workers making $40,000 or less have a 51% participation rate. Meanwhile, workers that make $50,000 or more have a 78% participation rate.

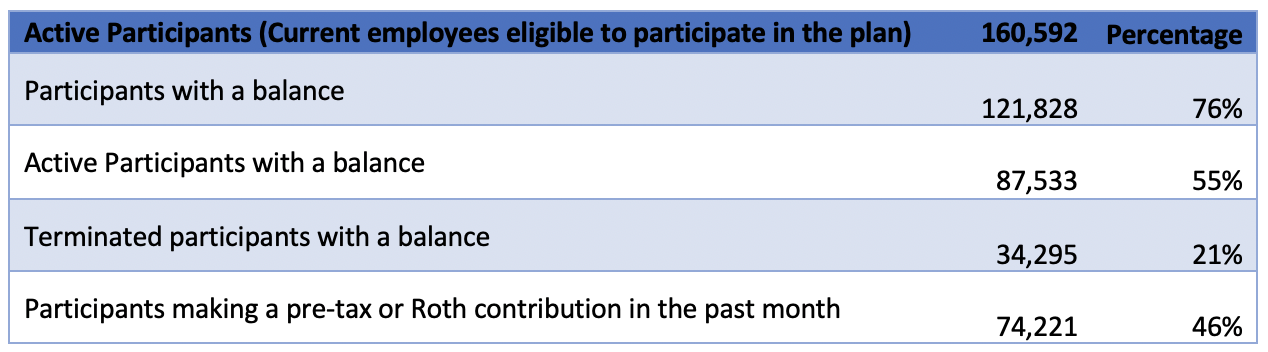

Overall, there are several factors that determine an accurate participation rate. LT Trust can produce customized reports to show you an accurate representation of a plan’s participation rate without these underlying factors skewing the data. For example, here is the LT Trust plan wide data at the end of March:

Active Participants (Current employees eligible to participate in the plan)

By choosing to define the numerator of participation as the number of eligible employees with a balance instead of the number of eligible employees making a pre-tax or Roth contribution, the rate could be overstated by 30%! In our own analysis, this difference is due to the significant number of plans where the employer contributes money to the employee’s account even when the employee doesn’t.

Want access to more industry insights? Click below to subscribe to our blog newsletter!