What Are the Benefits of Rebalancing your Portfolio?

The recent volatility of the stock market during the COVID-19 pandemic has likely delayed retirement for many Americans.

This is probably especially true for those older investors whose equity allocation had risen too high for their age due to the long running bull market. How many of these investors wish they could step back in time and implement a recurring rebalance for their portfolio that would have consistently sold a portion of their equity holdings and purchased more fixed income?

To first understand the importance of rebalancing your portfolio I would like to begin by providing a definition of what rebalancing is. Then we will look at 26 years’ worth of portfolio returns and track the equity allocation during that period. Record market highs seen over the last seven years as well as the current sharp market downturn can result in portfolios deviating from the target allocation you initially elected to embrace. I hope to demonstrate why rebalancing can offer value in achieving your retirement goals by mitigating your risk as you embark on decades worth of investing.

“Rebalancing is the process of realigning the weightings of a portfolio of assets. Rebalancing involves periodically buying or selling assets in a portfolio to maintain an original or desired level of asset allocation or risk. For example, say an original target asset allocation was 50% stocks and 50% bonds. If the stocks performed well during the period, it could have increased the stock weighting of the portfolio to 70%. The investor may then decide to sell some stocks and buy bonds to get the portfolio back to the original target allocation of 50/50.” (Investopedia Jun 22, 2019)

Rebalancing is more about developing a plan and sticking to it than it is about timing the market, but drift is going to happen naturally as one makes contributions at different periods utilizing the theory of dollar cost averaging but even more so when the markets are volatile. Whether we are in a bull or a bear market, one’s weighting in a portfolio can experience some drift. This market turbulence can lead to more exposure to equities that while in a bull market will result in potentially more risk than you may have originally planned for. The opposite is true in a bear market, if one’s exposure to bonds has experienced drift to the bond allocation it will limit the growth you could have had if your alignment is not as you intended.

In the chart to the left from Seeking Alpha, we are looking at a hypothetical portfolio with an initial investment in 2010 worth $100,000; such a portfolio could be easily replicated in an open architecture 401(k) plan. By October 31, 2015 the value of the portfolio has appreciated to $138,859 during this bull market. Overall, this by itself is a pretty decent return but look at the “Current Weight”. The reality is that we took advantage of the bull market, but the intent of the weighting is to guard against a shift to the bear market and this is not what we have here. In a bear market much like what we have experienced the last few months we would have lost 15% more than we wanted.

“Morningstar has run the portfolio's returns over the past 26 years, from 1994 through the end of 2019, and tracked its equity allocation and drawdowns over the period.

Exhibit 1, from Morningstar, shows how the weighting to equities changed over time.

The portfolio's equity allocation grew to 76% from 1994 through August 2000, leading into the first major bear market of the 2000s. It again peaked just before the start of the financial crisis in October 2007, with 73% in equities. As of the end of 2019, the allocation to equities reached its highest level over the entire period, nearing 80% of assets. Unfortunately, the elevated allocations heading into the two bear markets of the past 20 years meant more pain during those drawdowns and a longer wait to recover those losses.

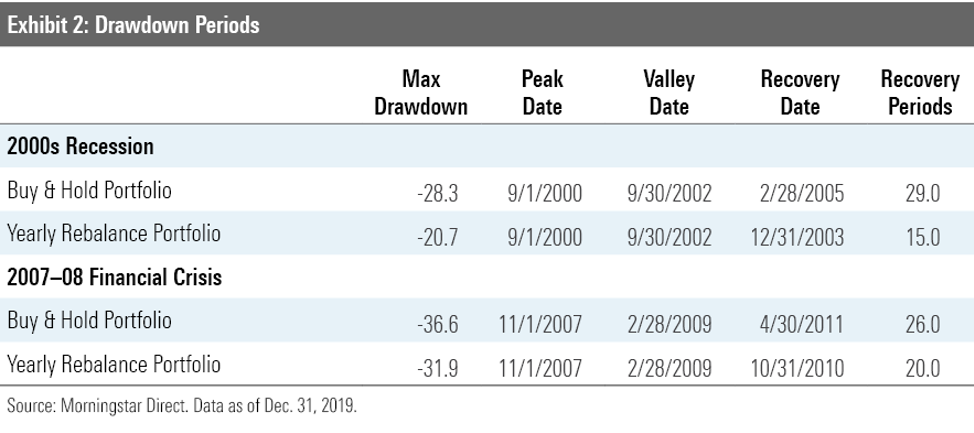

Exhibit 2, also from Morningstar, shows the max drawdown during both periods and how long it took the portfolio to recover its losses compared with the same portfolio that was rebalanced annually at the end of each year, arguably the simplest rebalancing strategy.”

Rebalance helps investors stick closely to a mix of assets that is expected to produce returns that can help them meet their goals with a level of risk they can tolerate. Over time, this allocation will begin to drift away from the target in favor of better performing, yet typically riskier assets. The resulting allocation alters the return and risk expectations of the portfolio, usually in the form of a higher expected return but with higher volatility. Rebalancing plays a large role in ensuring that the portfolio maintains its appropriate risk and return posture.

Figure 1, borrowed from Vanguard, depicts the distribution of historical returns for various asset allocations of a stock and bond portfolio.

Figure 2 illustrates these risk-control benefits. We project 30 years of hypothetical returns using 10,000 market return scenarios.

Figure 2a shows the distribution for the projections with no rebalancing in gray and quarterly rebalancing in blue. The gray distribution has fatter tails, meaning a greater possibility of a higher return but also a greater possibility of a lower return relative to a rebalanced portfolio.

Figure 2b depicts, in gray, that a non-rebalanced portfolio is typically more volatile. That means the median volatility of the rebalanced portfolio, in blue, is lower.

Figure 2c combines these risks and return results into a single statistic known as the Sharpe ratio. As our simulations show, rebalancing quarterly increases the portfolio’s Sharpe ratio, meaning that the rebalanced portfolio produces more return per unit of risk than the non-rebalanced portfolio.

All investing is subject to risk, including the possible loss of the money you invest. Be aware that fluctuations in the financial markets and other factors may cause declines in the value of your account. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. Past performance is not a guarantee of future returns. We recommend that you consult a tax or financial advisor about your individual financial situation.

Key Takeaways

Portfolio rebalance is an investing methodology of restoring assets weighting to the desired risk tolerance.

A person can use various strategies as it relates to an effective timing to utilize a rebalancing technique that fits their own retirement goals such as calendar-based, corridor-based, or portfolio-insurance based.

Rebalancing a low cost 401(k) plan with LT Trust is about as easy as can be. I have created a video that shows a recurring rebalance, just one of the options we offer as a possible rebalance strategy that can be utilized to keep your account within your risk tolerance. It is simple, it has an automatic feature allowing you to choose the frequency and it most importantly takes the human factor out of the equation.