Form 5500 - 401(k) Compliance: Testing, Calendar, and Process

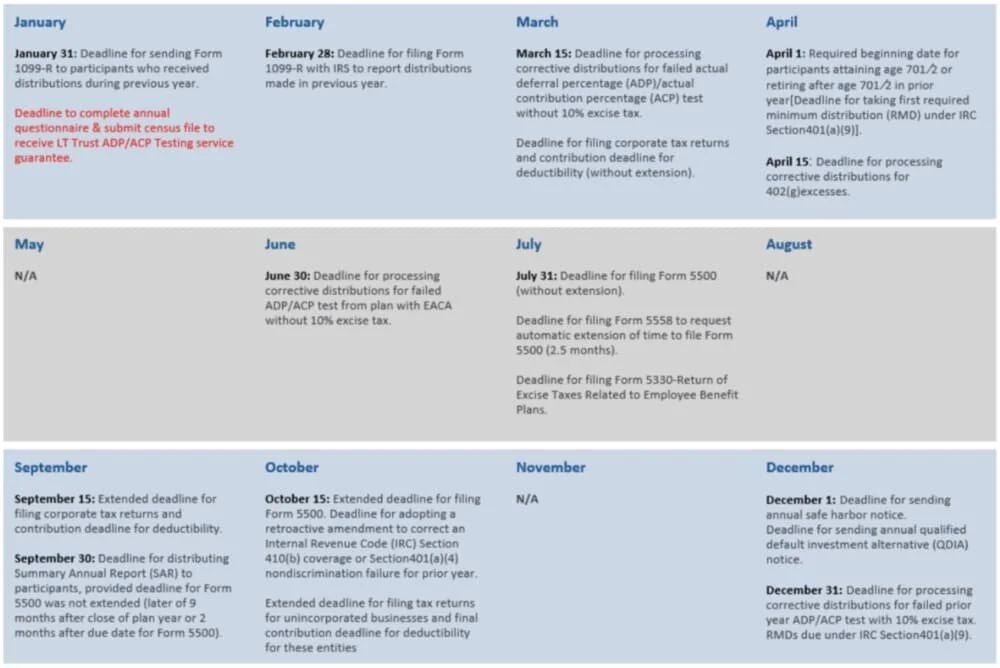

Filing the Federal Form 5500 is the last step of the compliance process, and needs to be completed by the employer every year, and the process usually begins immediately following the end of a plan year. For most of LT Trust’s small business 401(k) clients, a 12/31 year-end plan date is common, and there is a significant flurry of compliance activity surrounding the process. Although this year’s deadline has been extended for most plans, due to COVID-19, the 401(k) compliance testing remains the same. Let’s take a deep dive into the processes that the LT Trust team uses to ensure each client’s compliance needs are satisfied.

How Does the LT Trust 401(k) Compliance Process Work?

During the plan year when payroll contributions are made, additional data is also captured such as new employees and hours. Once the calendar switches to a new year, the first step in the 401(k) compliance process is to send an electronic census and questionnaire to all plan sponsors by mid-January. The census will already be pre-populated with data inputted each pay period and the plan sponsor needs to confirm our records match theirs.

To ensure LT Trust has equitable time to perform annual non-discrimination testing, including the processing of testing refunds (known as failures), by the IRS deadline of March 15th, LT Trust incentivizes our Non-Safe Harbor (NSH) clients with service guarantees. The criteria by which a Plan Sponsor can secure our service guarantee is as follows:

Plan Sponsors to complete and remit their EOY annual census and questionnaire, in good order, no later than January 31st.

Of the 4,200+ defined contribution plans we service today; approximately 1,792 NSH plans or 43% of our client are subject to the IRS deadline. The good news: LT Trust successfully tested 1,134 NSH plans, by the March 15th deadline; 263 or 15% of plans, received our service guarantees. An additional 871 (46%) of plans received our “best efforts” service pledge who remitted their census data files after January 31st. Only 138 or 7.7% of plans failed non-discrimination testing and required correction measures.

Overall, LT Trust completed 100% of the NSH plans who received service guarantees, by the March 15th deadline.

401(k) Compliance Testing?

As I mentioned, the first big government deadline for 401(k) plans is March 15th, which is when all ADP/ACP and Top Heavy non-discrimination testing must be completed and corrective distributions (for those NSH plans that fail testing) returned. From the IRS’s perspective, the reason non-discrimination testing exists is to ensure that qualified retirement plans are benefiting all employees and not just the owners or highly compensated employees.

One way to “pass” the 401(k) non-discrimination testing is having Plan Sponsors adopt a Safe Harbor 401k Plan. In general, the IRS will extend a Safe-Harbor Plan to automatically “pass” ADP/ACP and Top-Heavy non-discrimination testing (see above).

Safe Harbor Plans, by design, require key provisions that require the employer to make employer contributions, for example a 3% non-elective contribution that are immediately 100% vested to plan participants and/or a 4% matching contribution.

Most small-business owners elect to go the Safe Harbor route because it affords owners and or highly compensated employees (those earning above specific IRS compensation thresholds) to ability to defer up to the IRS maximum annual deferral amount (i.e. $19,500) for 2020.

LT Trust services approximately 3,066 Safe Harbor (SH) designed plans.

401(k) Form 5500

When it comes to 401(k) plans, the IRS requires federal filings on the plan level and for that, the Form 5500 is used. The IRS deadline for the Form 5500 to be filed is July 31st (for plans with a 12/31 plan year-

end). Like individuals, an extension can be requested via the Form 5558 which would allow plan sponsors to wait until October 15th to file. It is a fairly common practice for plan sponsors to file for an extension as that will allow business owners additional time to fund profit sharing contributions.

401(k) Contribution Deadlines

While participant deferrals must be funded in a 401(k) plan as quick as administratively feasible per the Department of Labor (DOL), employer contributions do not have to be funded until the Form 5500 is filed. This would include all Safe Harbor contributions, discretionary matches and profit-sharing contributions. While most matching contributions are made throughout the year, profit-sharing contributions are almost always funded as a one-time contribution following the actual year. This allows CPA’s to work with plan sponsors and small businesses to determine the best course of action for tax purposes.

Even though the main rush of compliance season is in the first quarter, preparation is a yearlong process. To maintain our status as a low-cost 401(k) provider, it takes a combination of technology and human capital to ensure all our client’s needs are met. Our consistent communications to our plan sponsors may seem excessive to gather data, but it is a necessary requirement to ensure we are able to meet deadlines on a mass scale. When asked to describe what the role of a 401(k) administrator is, my answer has always been to the point; “to make sure all steps are being done to keep the IRS happy”. That is our job.