What Can We Expect from the Biden Administration?

Joseph R. Biden was sworn in as the 46th President of the United States on January 20. While the incoming administration is expected to take significant steps on a host of issues in the coming weeks and months, there are several proposed changes to the American retirement system that could impact 401(k)s for people across the income spectrum and some that will increase awareness of the benefits of offering 401(k)s to employees.

The overriding theme from the Biden Administration’s expected proposals is providing greater incentive and access to retirement savings opportunities, either through leveling the tax savings playing field, boosting savings rates among individuals, or encouraging more businesses of all sizes to offer robust retirement savings opportunities to their employers.

In this post we’ll look at two of the main changes the Biden Administration is expected to propose or support and discuss the impact they may have on savers in varying tax brackets.

To Defer or Not Defer

Biden and his Vice President, Kamala Harris, focused heavily on addressing economic inequality during the campaign, so it is no surprise that one of the biggest proposed changes to the 401(k) tax incentive structure is designed to level the playing field of retirement account tax savings.

Right now, nearly two-thirds of the total tax benefit for 401(k) plans are enjoyed by the top 20% of wealthiest families. As designed, the higher the gross pay of an individual (and subsequently, the higher the tax bracket they fall into), the more that tax deferred 401(k) deduction will be worth in real dollars and as a percentage of income.

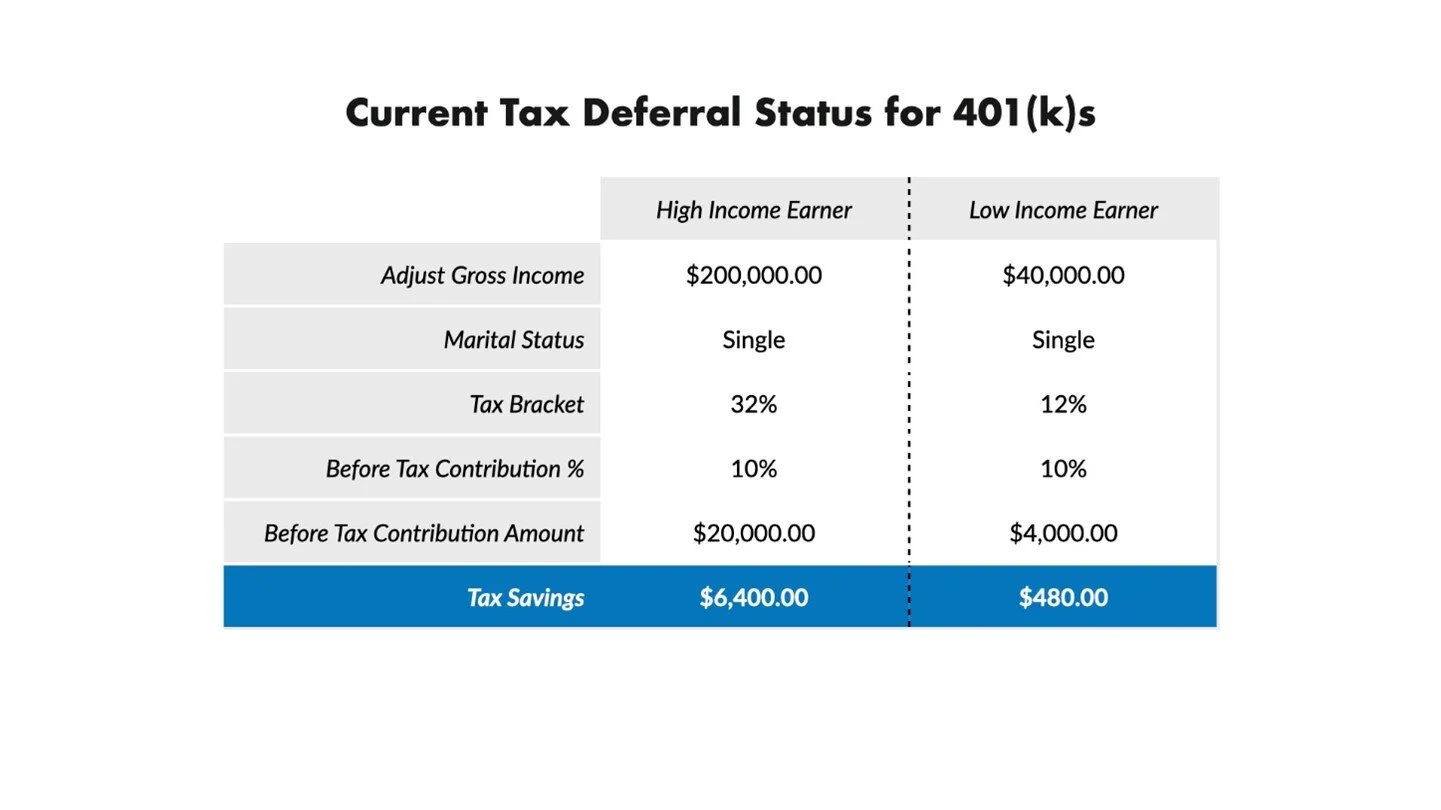

For instance, a 55-year-old single earner with an adjusted gross income of $200,000 per year and contributing 10% of her income pre-tax to her 401(k), will realize a $6,400 tax savings on that deferred income. That is just over 3% savings of her adjusted gross income. However, the same earner with an AGI of $40,000 per year and contributing the same percentage pre-tax would realize just $480 in tax savings, or just over 1% of their gross income.

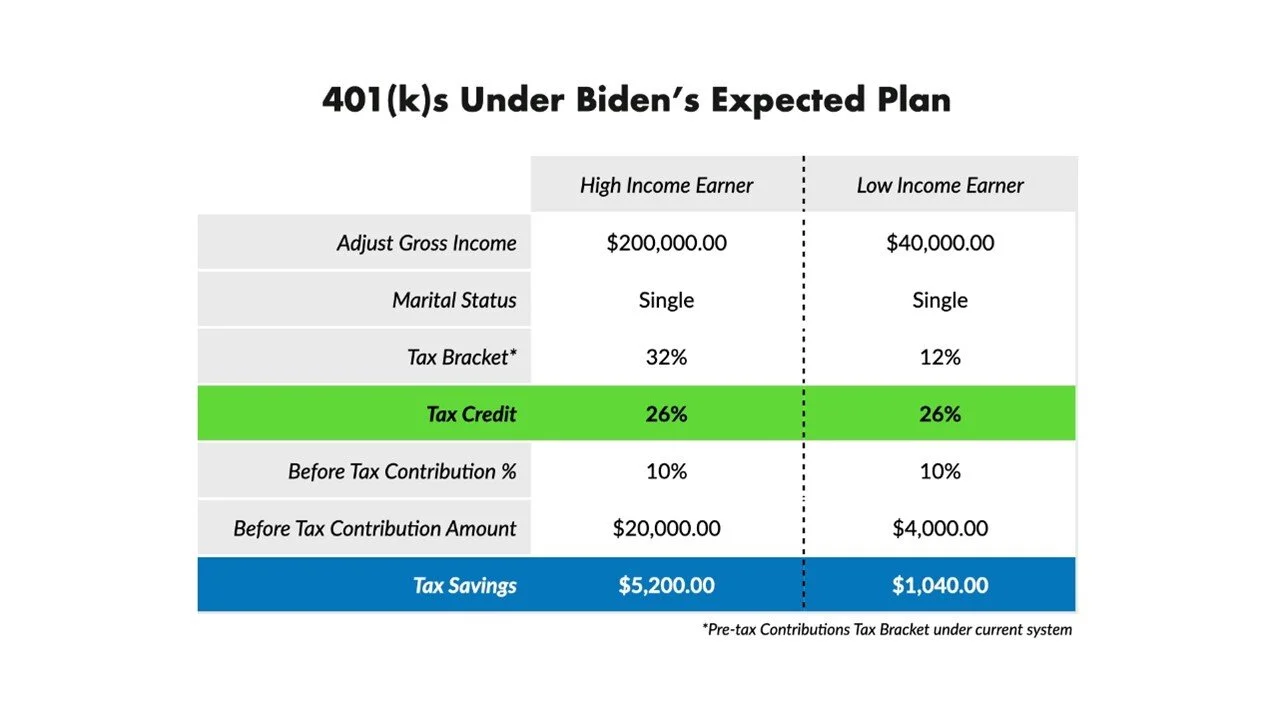

The Biden Administration is expected to propose replacing the tax deferral status for 401(k) contributions with a 26% matching tax credit. All workers who contribute to a retirement plan will receive a levelized tax benefit as opposed to the variable savings that disproportionately benefits higher earners.

When we look at the same two earners from before, it is clear that while the higher income earner will see a reduced tax savings, the impact to the lower earner is more pronounced. The higher earner would realize a $5,200 tax break (a 19% decrease) whereas the lower income worker would realize $1040 in savings (a 116% increase).

It is important to note that replacing tax deferral with a tax credit does not change the taxable nature of the contributions when they are cashed out during retirement. Instead, it levels the tax impact on the contributor today, offering tax savings right now with a similar tax impact at retirement. To understand the difference, tax deferral simply delays the payment of the taxes until retirement, while the tax credit offsets the cost of paying taxes on that income right now, but does so in a way that has a positive impact on lower earning savers in real dollars.

So, what does this mean for retirement savings rates? For the lower income earner, it will likely create increased incentive to contribute a higher percentage to their 401(k). But for the higher income earner, it is likely that they will look more closely at Roth 401(k) contributions as the allure of a post-tax payout will be higher now that the pre-tax deferral is minimized.

Despite the overall leveling of the playing field associated with this plan, there are concerns that it could reduce the incentive for investing in retirement vehicles overall with many high income earners choosing to invest elsewhere. It could also have the unintended consequence of lowering the financial benefit of some employers to offer 401(k)s to their employees in the first place, reducing overall access to 401(k) plans and matching contributions.

This will arguably be one of the most controversial policies the new administration will attempt regarding retirement savings and, as you can see, it is not without its pros and cons.

SECURE ACT 2.0

What is likely not to cause nearly as much concern among the retirement savings industry is the expected follow up to the largely popular SECURE Act of 2020. Building off that bipartisan bill’s success, the SECURE Act 2.0 will encourage Americans to save more by reducing barriers to 401(k) access for part-time workers, boosting retirement savings educational programs particularly in lower income areas, and directing the Treasury to make a concerted effort to boost the availability of Multiple Employer Plans (MEP) and group plans among small businesses.

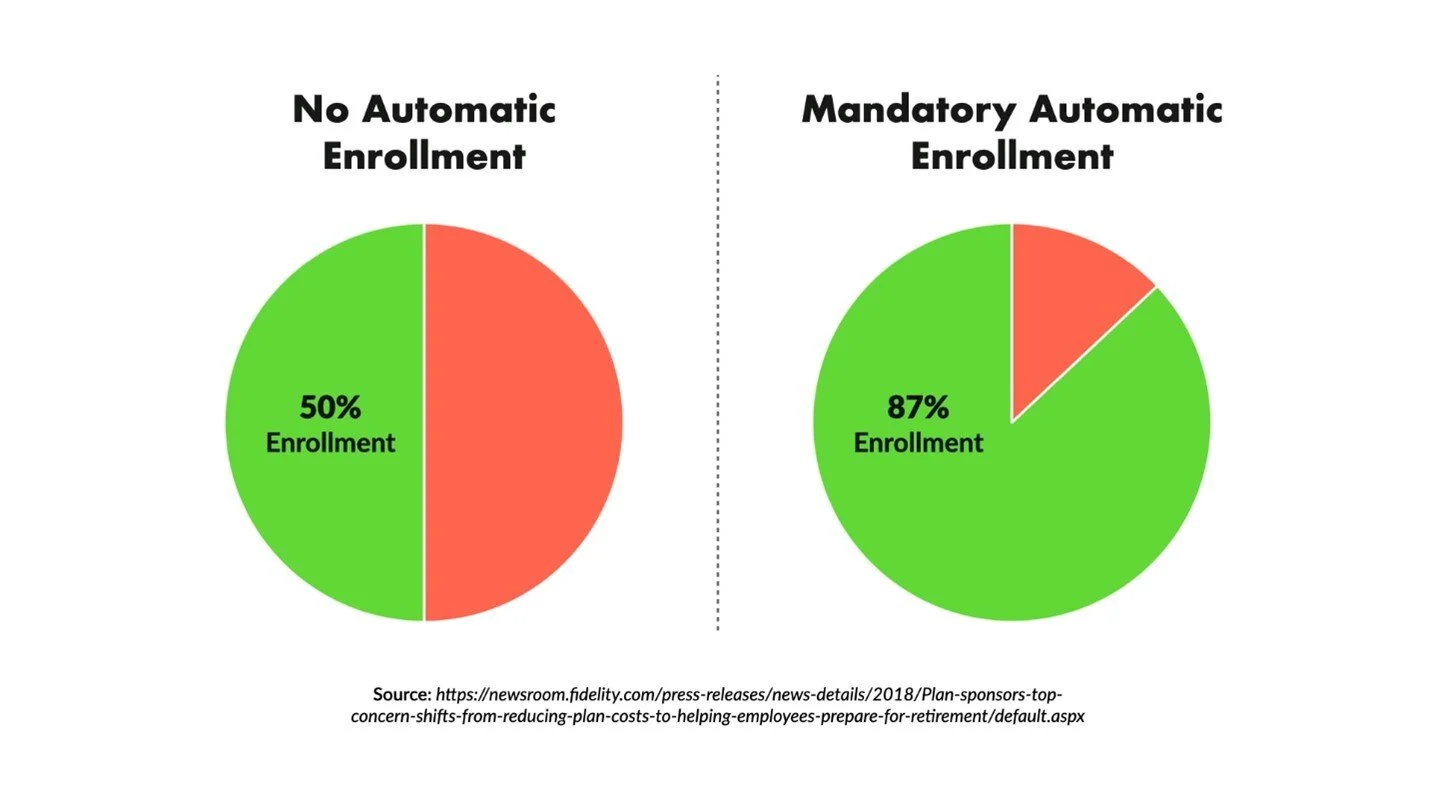

But arguably the biggest and most impactful component of the bill is expected to be implementing automatic enrollment for IRAs and 401(k)s nationwide. As many as 10 states have implemented mandatory automatic enrollment in state-sponsored IRAs with a good deal of success. Some 87% of those auto-enrolled remain enrolled compared to just 50% of those who are not auto-enrolled.

The original SECURE Act was one of the few bipartisan highlights of the last Congress and it is expected that the sequel will garner significant support from the financial industry and among leaders in Congress. When combined, these provisions are likely to go a long way in convincing more and more Americans to take their retirement savings seriously and offer incentives and education to do so.

Regardless of the political situation on Capitol Hill and its impact on certain legislative provisions, the incoming Biden Administration will have opportunities to convince more Americans to save for their retirement and make that saving easier and more lucrative — both of which are good for the retirement saving industry.

What This Means for Employers and their Employees’ Savings

Ultimately, many of the efforts the Biden Administration may propose have the aim of increasing retirement savings among those already contributing and improving access to retirement savings vehicles for those who are currently not in the market. Employers have the opportunity to take advantage of some of these policies, particularly those that increase plan participation and improve understanding of the benefits of offering retirement savings options.

That is a powerful place to be and as a leader in 401(k) recordkeeping. LT Trust is uniquely positioned to be a partner in helping employers navigate these new waters and better understand the benefits of offering 401(k)s to employees. We offer low cost 401(k) options for employers and decades of experience within the retirement saving industry to help you provide the best experience for your employees.

Learn more about our small business 401(k) plan solutions please or contact us